Defending with Green

Do you need to go defensive with green building features?

I recently heard a saying that no matter how thin the pancake, there’s always two sides.

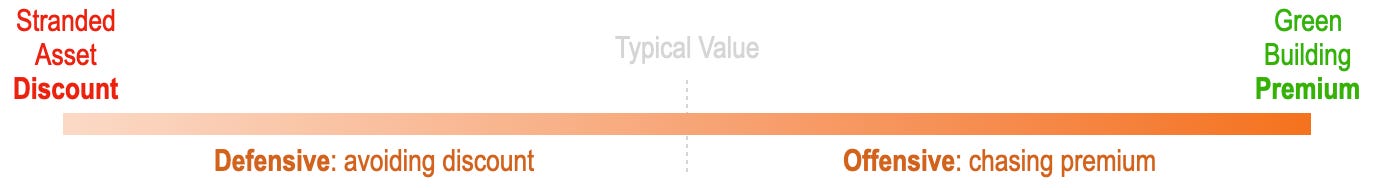

Useful perhaps, when considering how green building features might be viewed by the market… should they apply a premium, or a discount?

I’ve written before about the risk of being left behind and ending up with a stranded asset - something that does not meet the need of the customer and/or is non-compliant with regulations or law. And perhaps would require a prohibitive amount of capital to change that if left too long.

On the other side, is the new breed of buildings our industry is creating, at the forefront of technology, design and performance. These are the most sustainable buildings and are estimated to be commanding premium on their gross value up to 16%1 (take account of costs, and at best this looks more like net 6%). A word of caution though, these premiums could be based more on certification and (dare I say it) marketing, rather than evidence of actual building performance. Caution: the figures above have rather large error margins, as data on this is very limited. Regardless, I hope that with ratings such as Nabers UK, evidence of performance features more highly when assessing such premiums in the future.

So there is definitely willingness to pay at the moment, but it makes sense to expect this to decline as green building features become more mainstream. Generally speaking, we’re over on the right hand, offensive, side of the diagram at the moment, but in time that could shift left taking us back towards a market norm in the centre, and for some it might go further left into defensive mode, where adding green features is needed to avoid a value discount.

And even if you do have a green building, as technology and performance improves over time, ongoing investment will be needed to maintain position on the scale and avoid slipping left.

There’s a good argument that as we find ourselves back in the centre, it becomes ‘easier’ to estimate or calculate a discount than a premium. For example, high performance costs, risk of being non-compliant legally or physical risk of say flooding. Is this another reason why we should expect to hear more about discounts in the future rather than premiums?