2024 London Lookahead

Mixed feelings on a sluggish year ahead

How did 2023 play out?

When it comes to counting politicians, in particular Prime Ministers and Chancellors, 2023 was a quiet year, making a change from the rather turbulent 2022.

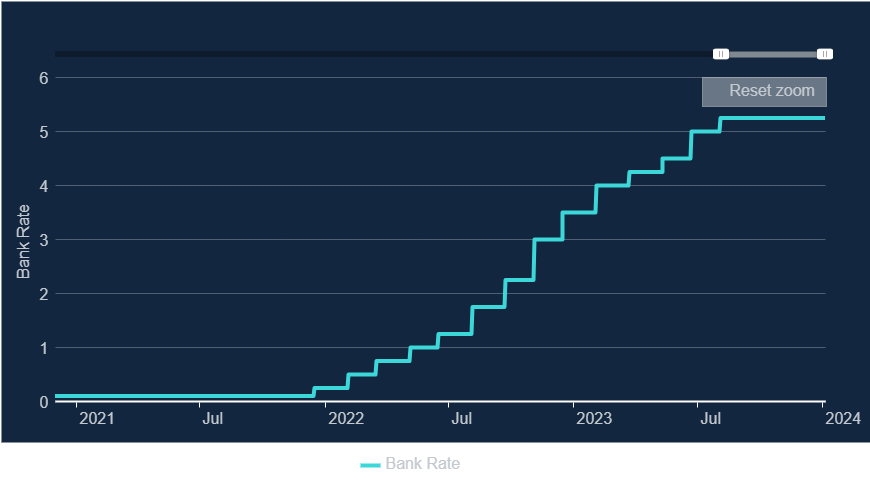

We started the year with interest rates at 3.5% and as expected, they continued to rise. By August we hit 5.25% which held through the rest of the year and the question now appears to be when a cut will take place, rather than if there is another hike around the corner. It seems that higher interest rates are doing their job, with inflation falling throughout 2023 from its 11% 2022 peak down to around 4% today. Good news perhaps, but the official message is that this remains too high and the target of 2% still stands.

In the property market the high interest rates have, as expected, impacted. The post-pandemic recovery was losing momentum in 2022, primarily due to material and labour supply issues, and while these disruptions eased in 2023, weak economic growth and higher interest rates reduced demand with some clients and developers scaling back investments.

2024 Lookahead

If 2024 is a bit of a “nothing year” without any more major hiccups, I think many will be relieved that things haven’t played out worse.

These days it feels hard to rule another speedbump, but until or unless that happens it feels like we are close to the bottom of the cycle, in search of green shoots.

Economics

The Bank of England's forecast of near-zero GDP growth until the end of 2024 suggests resilience amid the ongoing challenges. As in 2022 we are just about avoiding recession by definition, albeit with growth around zero for a sustained period does the label really matter?! Often, talk of recession can be said to cause it to happen, so perhaps we should be thankful that the murmurings have died down.

Through the year, stabilising inflation rates and the potential of interest rate cuts will no doubt help market confidence and investment strategies. Steadiness is key and I think “cautious optimism” is a good way to describe the 2024 outlook.

Unemployment rose during 2023 to around 4.3% and is expected to rise further as high interest rates and weak activity put pressure on hiring. Current forecasts have softened from this time last year, with expectations showing peak unemployment in 2025 just below 5%.

Politics

The big political question is when Rishi Sunak will call the general election, with three realistic options: a spring poll, an autumn poll, or a January 2025 poll. Recently, Sunak suggested he is ruling out a May 2024 election. I’m sure the timing is closely tied to economic performance so it’s no big surprise that he may wait until autumn or even January 2025 for the best chance of an economic rebound.

The two major parties are divided in their approach to construction and planning policy. Labour emphasises housebuilding, while the Conservatives acknowledge the need for planning reforms and are focused on infrastructure investment.

Sustainability

Sustainability remains a central theme. The property market is increasingly pushing for green building practices. This is not just a response to environmental concerns but also a strategic move to align with consumer preferences and new regulations. I think comments made last year still remain, with scepticism on the definition of ‘Net Zero’, and it also seems inevitable that the redevelop/refurbish debate will continue - for me there is no single answer and it should be retrofit first with decisions being project specific.

The circular economy continues to be of growing interest and I remain heavily involved and ready to help the industry adapt to being more circular. I also think digital innovation and smart technologies will play a growing role in new developments. My new business, Propetual, can help if you want to know more about this.

Costs

The balancing of material price stabilisation and labour cost pressures will continue - material costs have shown signs of easing but skilled labour shortages continue to drive costs higher. These factors, combined with economic conditions, are influencing project budgets and feasibility, making cost management a critical skill for developers and investors.

This has led to a rise in construction insolvencies and these are likely to continue through 2024, cascading through the supply chain.

Volume of Work

The volume of work in the overall construction sector shows a mixed outlook.

The industry is expected to experience some growth in 2024 and 2025 as the economy stabilises and strengthens, however it faces the headwind of weak economic growth and high interest rates. A gradual recovery in construction project-starts is anticipated from 2024, with momentum building into 2025 assuming a wider recovery gathers pace.

Private sector projects, especially in high-end development, have seen a slowdown, whilst public sector projects in affordable housing and infrastructure are gaining momentum, despite the cancellation of Phase 2 of HS2 which will have an impact.

I think the London office development market (especially the City and West End) will continue to demonstrate resilience with optimism among developers who bet on London's attractiveness for premium office space. The key word here is premium!

Values

2024 is going to see many loans reaching maturity - expect some challenging funding gaps appearing as the refinancing takes place in a higher interest rate environment and as values continue to undergo adjustments. Assuming yields peak before the end of the year, these challenges should reduce going forward and into 2025.

As noted in the 2023 Lookahead, 2024 could present a buying opportunity for those with cash or available finance and a clear vision.