2023 London Lookahead

Thoughts on the year ahead and a few observations on 2022

A bit like weather forecasts these days, I’ll start with a look at what just happened. Then we’ll get to 2023.

What the hell happened in 2022!?

Let’s be honest, we were expecting continued high (higher than 2%) inflation in 2022 largely due to the fall out of the economic covid measures and ‘supply chain disruption’. No-one had factored in the geopolitical challenges that would emerge in February and continue to play a part in how things look today. And not only did we smash through inflation predictions, but we also swept through politicians with three prime ministers and four chancellors.

As we started 2022, we had already seen the first interest rate rise in December 2021 (0.1% > 0.25%). However they kept on going up and up… and up - first by 25bp, then come August we got 50bp and by November we saw a 75bp move (to 3%). These rising interest rates are intended to cause pain, to reduce activity, to put the brakes on the economy (and inflation). By the end of the year signs of such softening and slowing were clearly visible, but just because 2022 is over doesn’t mean the pain is. The year ended with inflation still around 10% and whilst 2022 was an unpredictable and rocky ride, 2023 hardly seems a brighter prospect.

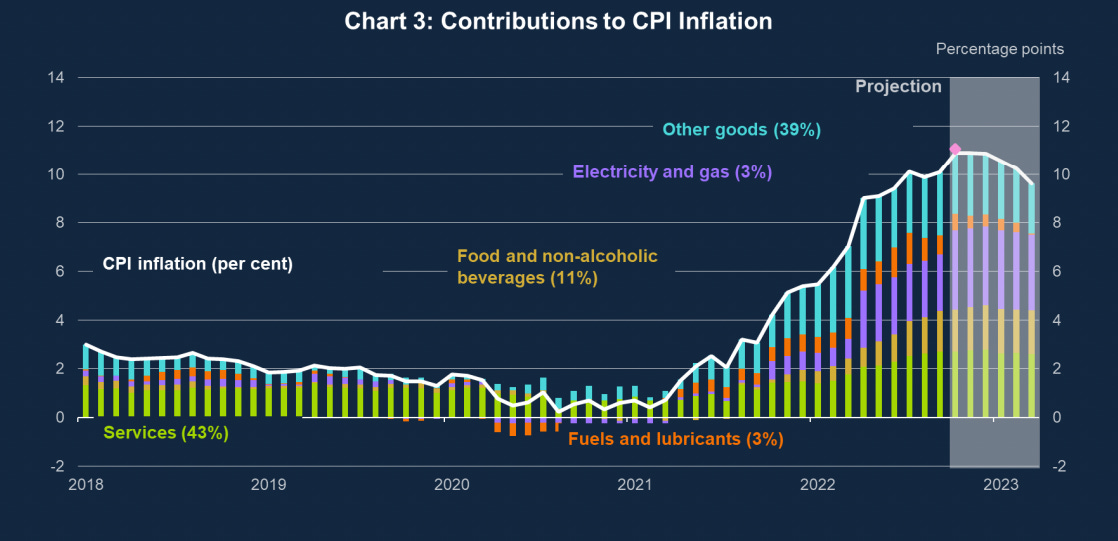

The chart below gives an idea of what made up the recent CPI inflation and includes an indication of how it might start to reduce in 2023. Remember, this is showing inflation (the rate of change of prices) reducing, not prices.

2023 Lookahead

2023 will be a period of high market stress, but for those with knowledge and their capital ready, I’m sure it will present opportunities - prepare now and be well positioned to benefit from the next upturn.

Paraphrasing Sir Dave Ramsden, BoE in November, the Monetary Policy Committee will inflict necessary short term pain on the UK economy in order to return us to 2% inflation, stability and certainty (the foundations for sustainable growth).

Key Trends

Sustainability

The previously mentioned flight to quality will continue, including focus on top locations and strong long-term fundamentals. For me this means Grade A office space, but it could also include logistics, affordable housing and some essential retail. There will be opportunities outside of these, but they’ll come with additional risk.

But it seems that sentiment on how quickly developers will hit 'Net Zero’ has recently been knocked, with the number now at 54% after 2030, compared to 70% last year saying they’d hit the mark before 2030 - that’s quite a swing. Speculation is that this is a combination of better understanding the definition and what it takes to achieve it. And it seems most would welcome clarity on regulation which might guide them in their decisions, as well as the basic definition! Survey data shows that despite an improved understanding, the industry continues to lack clarity and a clear definition of ‘Net Zero’. For me, it’s the offsets that remain poorly understood and better knowledge of these could unlock the wider story and trust of ‘Net Zero’.

Grade B

In amongst the office flight to safety, could be an opportunity in Grade B stock. If a shortage of Grade A office squeezes the supply, perhaps it will be possible to cherry pick some Grade B with the most potential and create space for tomorrow’s flexible occupation needs. But think again and I wonder if some owners/developers will even have a choice if their ‘do nothing’ is soon to be holding stranded assets that don’t hit the looming EPC B targets?

So maybe this will be a forced move… there’s no escaping the huge quantity of space in London which is EPC C or below. It is thought that to hit EPC B or above by the 2030 deadline (without reducing stock levels), around 15m sqft needs to be built or refurbished each year - we are not on target to meet this, and I cannot see the economic backdrop helping change this in the short term. Is this setting up for a massive push in the second half of the decade?

Viability

It hardly takes a rocket scientist to see that higher cost of debt and lower values will prove a challenging combination for anyone seeking finance (or refinancing) in 2023. These viability challenges and inevitable slowing of some projects casts doubt on the pipeline predictions and could exacerbate the apparent slowing of how the industry is working towards ‘Net Zero’.

Costs

Also impacting viability, is the continued high costs of construction. There seems a consensus that inflation will reduce during 2023, but that does not mean prices will come down - in fact, most expect that at best high prices will plateau and become embedded in the market. In the Deloitte survey, construction costs remain far out front as the biggest challenge to development. Interestingly, Brexit and Covid have fallen off the chart. More on TPI below.

Volume of Work

Deloitte’s latest data shows 15.6 million sqft of new office stock is expected to be delivered between 2023 and 2027, all of which is yet to begin construction. 2023 is labelled 'Year of the Catch-up' as they expect the highest volume of new office space for twenty years. And then they call 2025 the 'Year of the Investor', reflecting potential opportunity as the market rebounds out of recession, see Values below.

Interestingly, and contrary to the 'covid catchup', over the past six months there were no new starts in Deloitte’s emerging submarkets1 causing the total amount of under construction activity to drop by 9%. There's definitely some safety in the more established City and West End.

When it comes to sentiment, 55% of developers expect their development pipelines will decrease over the next six months. This is more pessimistic than previous surveys, and put down to construction delays, rising costs, and financial and economic uncertainty. Deloitte think this will provide opportunities for investors to acquire sites at lower prices.

Unemployment

In the last year or so, rather than slowing as demand in the economy has slowed, demand for labour has remained resilient. But is that now about to change? A growing weakness in demand associated with recession means it is likely unemployment will rise from the start of 2023 throughout the three years of the BoE forecast. Whilst more unemployment doesn’t sound great, it is an important factor which will influence when interest rates might start to turn.

In construction, Alinea note that low unemployment (aka skills crisis) was compounded by Brexit and continues to bite, albeit offset by a productivity increase. Perhaps our industry will buck the wider trend, as Alinea and G&T see a need for more skilled people and a general pressure to train and develop ‘home-grown’ talent. Many advisors in our industry predict pressure in the labour market will be a major factor for TPI in 2023 as wage pressure maintains its grip.

Values

Yields are going up, but for how long? Back to the viability challenge, lenders are going to be more nervous when it comes to offering development finance against Gross Development Value, because they will be unsure of the rents and exit yield.

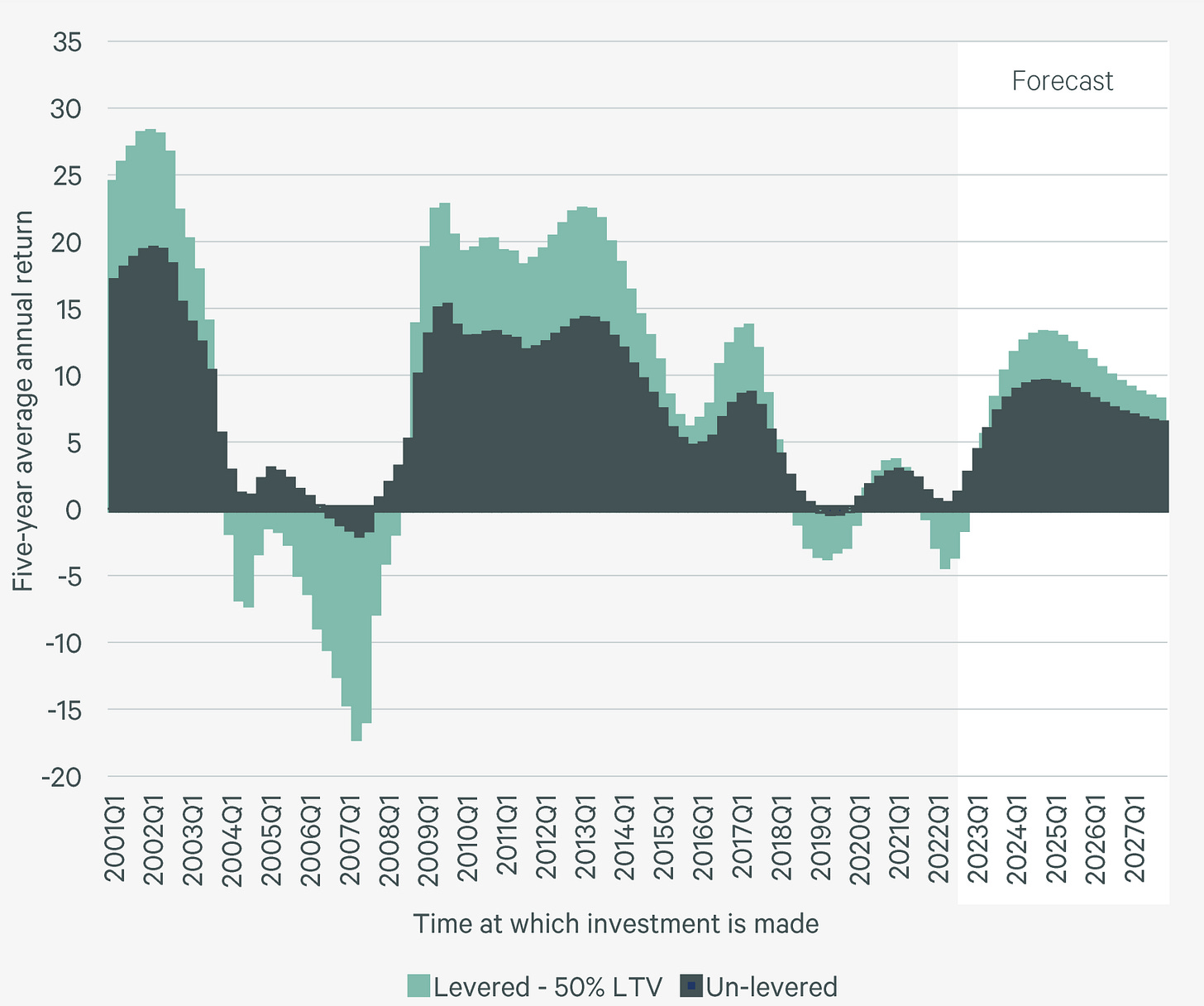

The chart below paints a positive picture for investment returns in coming years (there’s the opportunity again). It is predicated on inflation peaking in Q1 2023 and reducing during the year, along with interest (and debt) rates quickly following on a downward trend. Yields coming back down will also play a part if this is to play out as drawn.

Inflation & TPI

There appears a consensus that 2023 will be a return to more familiar TPI figures, with forecasts around 2-3%. As mentioned already, factors such as wage pressure and energy are now driving inflation, albeit partially offset by more recessionary factors such as the economic slowdown and reduced order books. Remember, inflation might be coming down, but prices are still going up and the price rises we experienced in 2022 are now becoming embedded.

References

Vauxhall Nine Elms Battersea (VNEB), Stratford and White City