2022 looks set to be a busy year, perhaps with a few cost related speed-bumps on the way. ESG will continue to play a big part in how we design and manage property, as the industry grapples with the definition of Net Zero Carbon.

There is much to be positive about, and I for one am looking forward to the challenge. I just hope that cost pressures do not dilute the brilliant, forward-thinking, sustainable designs which we are all pushing for.

Volume of Work

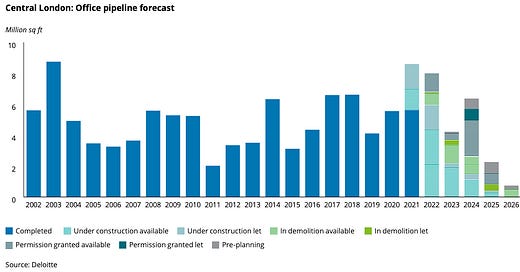

Expect a busy 2022 as positivity seen during the end of 2021 continues into the new year. A rising workload will add further pressure to the cost challenges the industry is facing.

2023 appears quieter, perhaps the lag of new build project that were put on hold during 2020 is a factor. That said, shorter refurb projects could appear on the map during this year and increase the 2023 volume by the time we get there.

Key Trends

Cost Increases

Inflation is all around us right now, whether this is at work in the property sector, during the weekly shop or filling the car up. Unfortunately, I don’t see this changing during 2022. See below for more on this.

Net Zero Carbon

Partly driven by minimum standards, but most developers are now on-board and actively taking measures to achieve Net Zero as it quickly becomes a market expectation. The chart below clearly demonstrates the industry’s ambition.

A problem to be solved in 2022 is the lack of understanding of what Net Zero actually means. I personally feel like many projects are currently being labelled with this tag, without being able to fully explain how they are achieving it.

As part of this drive, expect to see Contractors doing their bit to decarbonise their activities - think electric plant and equipment, rules on idling plant, operator education and also a focus on sub-contractor and supplier activities such as transport/logistics.

And whether this is through construction activity or design of a new development, expect to see fossil fuels becoming a curse word. In my developments, fossil fuels as part of the design are simply not allowed, the only exception that remains is backup generators where I am frustrated that technology has not yet provided us with a better solution, and occupiers still think they need this despite most things being stored in the cloud.

Circular Economy

As we all become more knowledgable on Net Zero and other sustainability metrics (E.g. Embodied Carbon), I predict that the next wave of attention will be how to be more Circular.

This could include anything from salvaging material from existing buildings, designing for disassembly, leasing of fixtures/fittings rather than purchase, innovative take-back schemes and more. The industry will make good progress in 2022 on defining better ways of quantifying how Circular a development is.

WFH, Hybrid Working & Amenity

Despite the endless webinars on ‘the future of the office’ during 2020 and 2021, I never thought the office was dead. It just needs to respond to changing demands, and this appears to be what is happening. Couple that with renewed confidence in leasing and developer sentiment during the last six months, and I’m confident the office is here to stay.

Clearly the needs of a new office are changing. Space requirements, ventilation, all things ESG, amenity, and flexible use are becoming less nice to have and more a requirement of Grade A space. Achieving some of these in existing buildings can be a real challenge though.

Valuing Sustainability

More is needed on this and I think 2022 is the year where things will (at least start to) change. RICS are consulting on a Draft Guidance Note for commercial property valuation. This cannot come soon enough, as current valuation methods are out-dated and backward looking. We need sustainable designs to get the estimated values they deserve. This in turn, will help reinforce their business cases and avoid the unfortunate ‘value engineering’ which does still happen when projects come under cost pressure - definitely a concern during 2022.

Once we are clear on how to value sustainable development, I do envisage some sort of two-tier marketplace emerging (not necessarily in 2022). Whether you consider the best performing developments to command a premium, or those un-achieving to be discounted, doesn’t really matter. But there will be more stranded assets emerging from this.

Environmental Trade-offs

As we all look to improve our project environmental performance and planning authorities are waking up to this need too, I expect to see more examples where red-lines are re-drawn. For example, heritage assets that once may have been no-go in terms of alteration, may soon see increased leniency when change/adaption is considered, if any harm is offset by meaningful environmental benefit.

Each instance needs considering carefully, but I do see this as something that needs to happen, if at least just to make sure the balance is right in this new era. No planning authority wants a collection of stranded assets on their patch, and we have to acknowledge that if a key collective target remains 1.5degrees as per COP26, some things may have to change.

Inflation & TPI

Costs seem to be only going up, largely driven by two key reasons, Brexit and Covid. Something less talked about in the industry is the quantitive easing which has been happening at pace since the start of Covid, not just in the UK but globally. I’m not an economist, but increasing the money supply must surely add upward pressure on all goods and services.

Many projects this year will no doubt find themselves facing the unwanted speed-bump of a ‘viability challenge’ as inflation during 2022 is predicted to be somewhere between 2-5%, with 2023 only just coming in lower. I hope most are able to weather this storm.

Material prices across the board remain on an upward trend. Labour shortages in general are continuing to put pressure on prices, with further pain added by the ongoing HGV driver shortage. Meanwhile rising energy prices are being described as the catalyst for a second wave of inflation, with high energy intensity products such as glass, cement and concrete exposed.

And let’s not forget, these predicted increases are on top of some significant moves that have already occurred during 2021: Steel Reinforcement +65%, Structural Steel +75%, Sawn/Planed Timber +74%, M&E Components +10%.