Navigating the Shift

Canary Wharf's Evolution in a Remote Work Era

Canary Wharf's history began to take shape in the 17th century as it transitioned from marshland into a bustling import and export hub. Under the banner of the West India Dock Company, it played a pivotal role in trading goods between British territories and international partners, notably the Canary Islands. From 1800 until the outbreak of World War II in 1939, Canary Wharf stood as one of the world's most significant trading ports. However, the Second World War inflicted severe damage, leading to the closure of many warehouses.

The transformation of Canary Wharf from a derelict and abandoned area to its current state is nothing short of remarkable. Major companies began relocating to the district in the 1990s following Thatcher’s creation of the London Docklands Development Corporation - led by Paul Reichmann, however the idea came from American bankers. In the decades since, Canary Wharf has emerged as an urban centre, forged from a monotone palette of stone, glass and metallic cladding - no bricks here! For thirty years it has been home to many big businesses, many of them law firms and banks.

But it hasn’t all been plain sailing. The property crash forced Reichmann’s business, Olympia & York, into bankruptcy in 1992 and the estate into administration. It took 3 years for him to regather investment to buy it back, before a turbulent takeover by ‘Songbird’, a Morgan Stanley consortium, in 2004.

Then collapse of Lehman Brothers in the 2008 GFC also hurt the estate with a major vacancy and sizeable hole in the balance sheet. But it survived and in 2015 a Brookfield Property Partners and QIA (Qatar Investment Authority) JV acquired Songbird. This JV remains the owner today.

Another major twist was the pandemic in 2020 and ensuing work from home culture that led businesses to think about the space (and location) they need. It’s also clear that the CWG development team had been reconsidering whether being so monocultural and ‘all in’ on office was such a good idea. Ideas from back in the early 2000’s had been dusted off and a new Wood Wharf masterplan was designed by Allies and Morrison in 2013 - including significant retail and residential.

And to bring things up to date, the recent news of HSBC and Clifford Chance’s departing of Canary Wharf, plus the retrofit saga of M&S have added another dimension to the conundrum. Twenty-something year old office buildings are now coming vacant and the ever sustainably minded CWG needs to work out what to do with them. No longer are they the developer that just builds shiny and new, but they now need to become experts in refurbishment and repositioning.

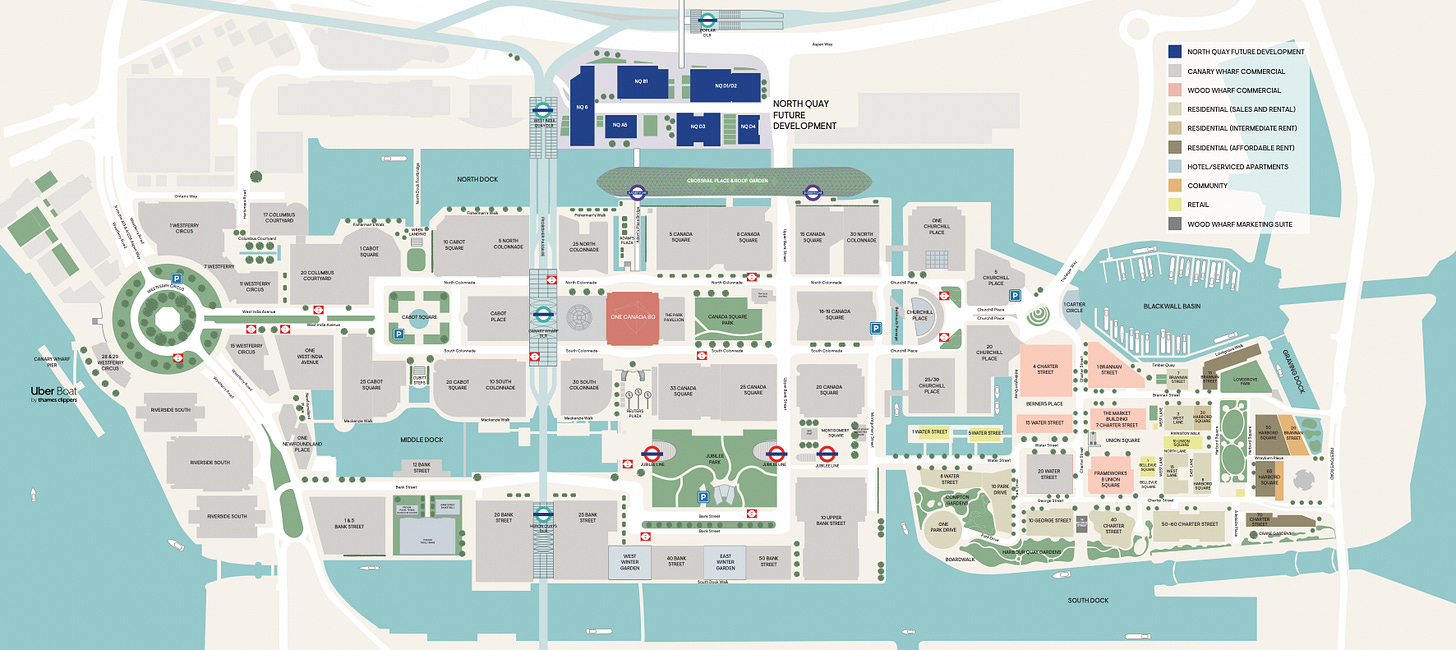

Cue residential, retail and life sciences. Different use classes bringing variety, activation, richer design and street life into the once office dominated district. The Elizabeth line (see image above) has also made Canary Wharf even better connected - crucial whether you are retaining office tenants or trying to tempt commuters to move east and commute West.

Residential development is focused on the multi-billion pound Wood Wharf to the East of the estate. It’s the biggest addition to the original SOM 1985 masterplan, aiming for 3,600 new homes and 2 million sqft of office space, although I think the office might now be under review given the recent news. The first buildings are now occupied and in the photo below you can see the view from the new Boardwalk which edges the South Dock.

Life Sciences is the new idea. The North Quay area is so far undeveloped but this is changing. A variety of lab types totalling more than 6m sqft are in the pipeline for the rest of this decade, interspersed with complimentary office space curated for healthcare and research, all with the usual integrated underground basements and infrastructure we’ve come to expect from Canary Wharf. The first of these lab buildings is already on site whilst in parallel some tenants operating in this space have already taken out office leases in existing buildings.

What has triggered this piece? Well, aside from the recent news articles, I visited Canary Wharf last week with a couple of new additions to the CWG showing us around. Jack Brewster and Ellen Lockhart used to be at Grosvenor, but are now key people in driving forward this new era, with Jack focused on Wood Wharf and Ellen on North Quay.

My visit was on a sunny, late summer afternoon and the whole area was pretty busy. I’m sure the weather helped, but it’s certainly not a dead zone. I’d like to know how many people were working on the office floorplates at that time - perhaps it was all of those people that ditched the desk for a drink in the increasingly activated public spaces.

Below is a photo from Jubilee Park, which I confess I didn’t know existed until last week. It’s not huge, but demonstrates the intention to improve greening and Jack explained the ambition to turn Mid Dock green in the very near future. One of the challenges (as always with real estate) is ownership and existing infrastructure. There’s loads of opportunity to green swathes of space around the three docks, however shared interests and existing assets often slow down decision making, funding and management arrangements.

So how do things look for CWG?

It is certainly a new era. Pandemic, grown up buildings and refurbs, remote work, diversification from office and the Elizabeth Line are all driving change. But the thinking around some of these factors has been emerging for a few years now and it will take a few more years before we can really judge the success.

There are some that say Canary Wharf is in trouble, but if I’ve learned anything from writing this piece it is that the estate has already survived a couple of major upsets in the past, so what is one more? The economic situation we currently find ourselves in will no doubt add further pressure to the melting pot of challenges, but as someone once said, in the middle of adversity there is great opportunity.