Future of the central London office

Headlines and reaction to the CLF's recent report

I wrote Flight to Quality a couple of weeks ago which landed just ahead of the Central London Forward (CLF) report titled “The future of the office in central London”. Here, I react to the CLF report and summarise the key conclusions and recommendations.

The report confirmed a few things I think we already knew:

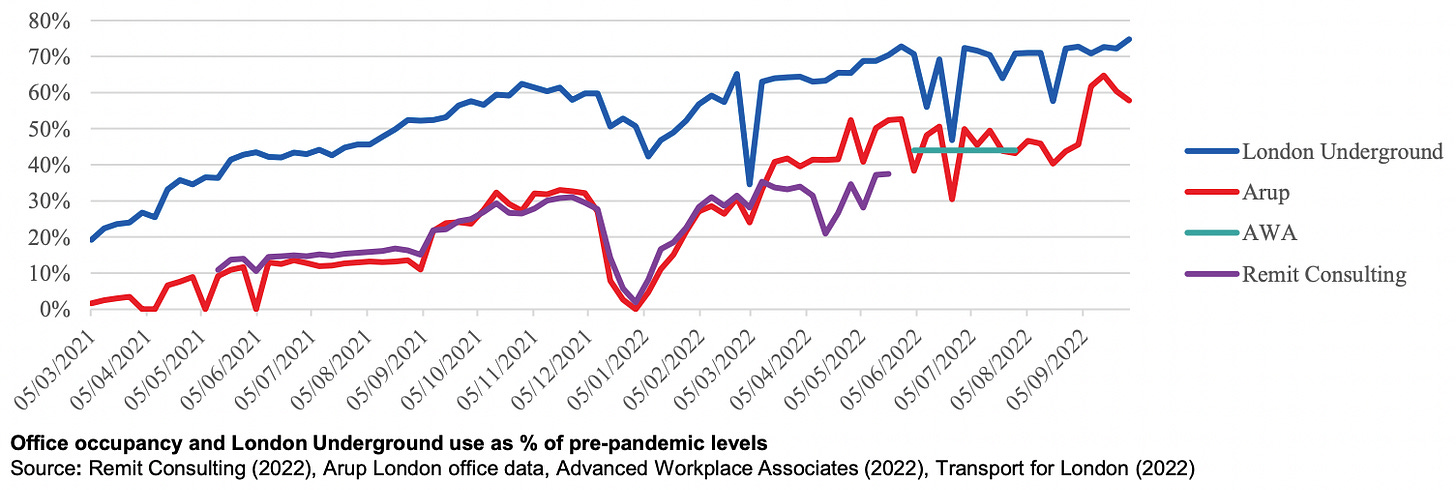

Attendance is still around half of 2019 levels

It is focused on the middle of the week, with Friday being the quietest day

Hybrid is the assumption going forward

Occupiers want flexible, sustainable, high quality spaces

And then there were a couple of things I didn’t know:

London’s attendance recovery appears ahead of New York, but behind Paris

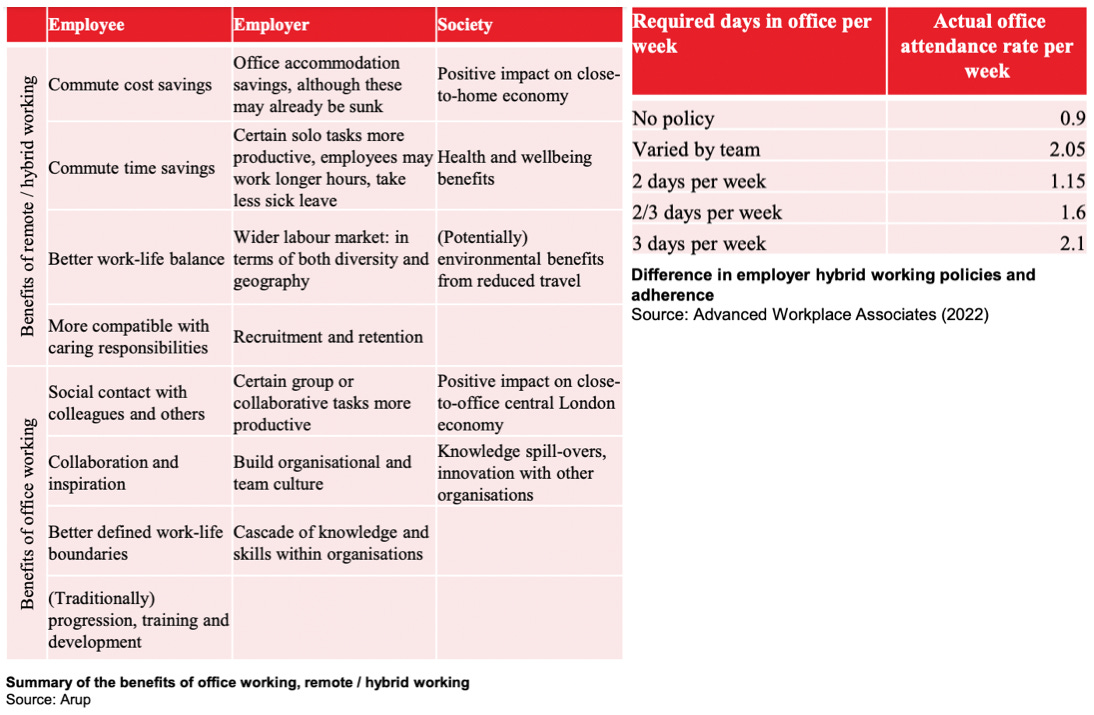

There’s a mis-match of expectations between employers and employees, with workers falling a full day short of the minimum that has been specified!

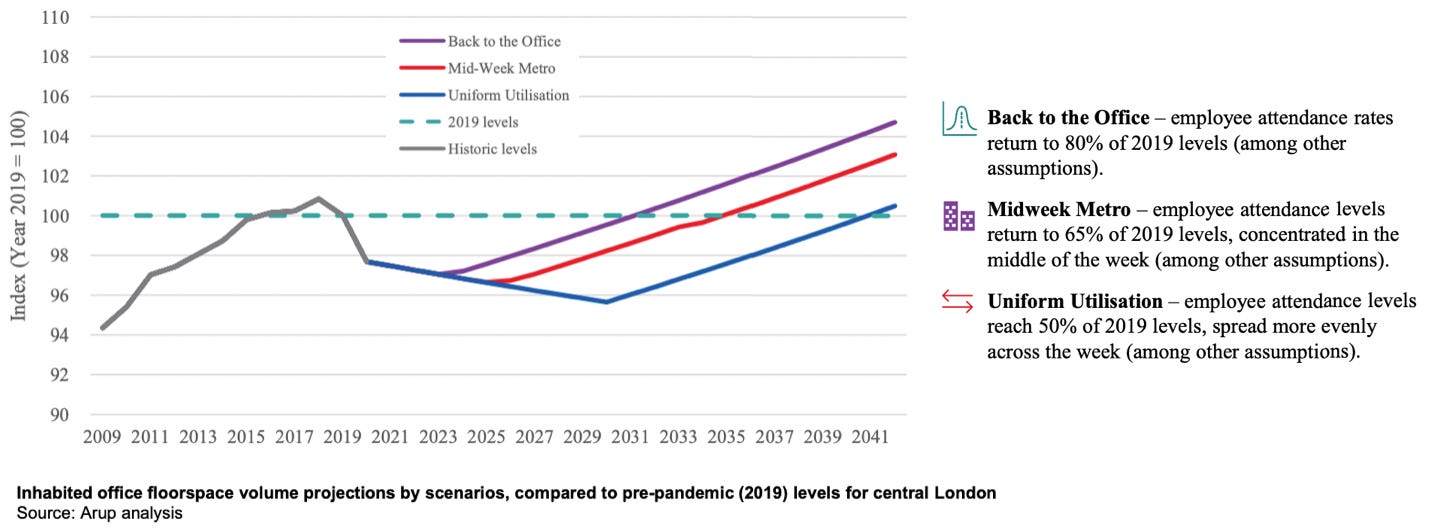

Even the most bullish predictions on office attendance (back to 80%) only returns to 2019 levels by 2031.

Here’s the most interesting charts and tables:

Conclusions

The report identifies the local economies in the city as being vulnerable to these new patterns. Personally, I think any business that is still trading has already had to adapt to this, e.g. with quieter Fridays. On the flip side, spend that would have been in the city centre is now occurring further out.

Another conclusion is that hybrid working is an opportunity. I absolutely agree, however from the mis-match mentioned above, it seems we haven’t yet found the right balance or degree of trust. I like the point about how we need to do better to compartmentalise tasks to suit either home or office. My view is that we will still find ourselves closer to the bullish prediction (back to around 80%) over a long enough period of time. I like the table summarising the benefits of office and home, however I don’t think it is equally balanced, therefore the ratio of office:home wont’t be either.

In agreement with my piece Flight to Quality, it says the prime office market might be sustained by the search for high quality space, and that lower grade offices in peripheral locations will see the largest softening in demand - I’ve spoken about these potentially becoming stranded assets, however the report suggests conversion to alternative uses might be the answer.

Something I had not mentioned in my piece is the wider offer that central London has - leisure and cultural facilities on the office doorstep are big attractions, and the report concludes that the The City and West End will remain desirable. I can certainly relate to this as a someone living on the edge of London, as some decisions to come to the office are influenced by after work social commitments.

Recommendations

‘Best of both worlds’ is the key, underpinned by sharing of data to help understand trends and responses to them. Transport should be flexible and affordable.

On the peripheral locations that may see the most significant softening, there could be support for a transition to other uses where appropriate. If these are going to be stranded assets, then I support policy that would help facilitate these escaping such peril.

Interestingly, there’s a suggestion to be more efficient with office stock usage, with flexible use by others during the quieter periods. I think lot’s of office occupiers and landlords have been looking at this, but it is hard to achieve in reality and needs a lot of care when it comes to overlaps and security. I see this as another way to be more sustainable and make better use of a space.

There’s another push for abolition of VAT for low carbon refurbishments. It’s absurd that new build is zero VAT and refurbishments are not - surely this will change soon as I have not found anyone who disagrees with this proposal!

All in all, the data is useful to show where we are on the trend back to the office and the recommendations are a good reminder that we must proactively consider how to deal with the repercussions of hybrid working.

Really good piece Steve which both informs and challenges the status quo VAT being an excellent example. Well done regards Charlie